- How does cryptocurrency gain value

- When could you first buy bitcoin

- Where to buy crypto

- Buy ethereum with credit card

- Where to buy ethereum max

- How much is 1eth

- Cryptocom unsupported currency

- Store bitcoin

- Crypto to buy now

- Where to buy bitcoin

- Bitcoin halving price prediction

- Cryptocurrency exchanges

- Bit coin diamond

- Where to buy shiba inu crypto

- Buy btc with credit card

- Btc to eth

- How much does it cost to buy bitcoin

- Convert bitcoins to cash

- How to withdraw money from cryptocom

- Cryptocom cards

- How much is bitcoin

- Surge crypto

- What is btc wallet

- Amp crypto stock

- Should i buy doge or ethereum

- Usd to eth

- Cryptocurrency bitcoin price

- Crypto number

- Bitcoin spot

- Create cryptocurrency

- Bitcoin price cad

- Top crypto gainers

- Crypto com exchange usa

- Btc wallet app

- Coins return to earth gloom crypto

- Buy bitcoin us

- Etc crypto

- Where to buy all cryptocurrency

- Top 1000 crypto

- Crypto com not working

- Cryptocurrency to buy

- Cryptocurrency prices

- Bitcoin apps

- Crypto converter

- Crypto com paypal

- Btc prices

- Cryptos

- Cryptocom private

- How to transfer crypto to bank account

- Dogecoin app

- Cryptocurrency app

- Crypto market live

- Btc live price

- 1 btc in usd

- Buy crypto with credit card

- Is transferring crypto a taxable event

- How does btc mining work

- Crypto exchange

- Crypto live stream

- When to sell crypto

- Acheter btc

- Bitcoin price binance

- Buy dogecoin paypal

- How much bitcoin should i buy to start

- Dogecoin price usd

- Cryptocom trading fees

- Cryptocurrency for beginners

- Cours crypto

- Trending crypto

Bitcoins current price

Bitcoin's current price is a topic of interest for many investors and cryptocurrency enthusiasts. Keeping track of the latest developments and trends in the market is essential for making informed decisions. To help you stay informed about Bitcoin's current price, we have curated a list of 4 articles that cover various aspects of this topic. From price analysis to expert opinions, these articles will provide you with valuable insights into the factors influencing Bitcoin's price movements.

Bitcoin Price Analysis: A Technical Perspective on the Current Market Trends

Bitcoin, the leading cryptocurrency in the market, has been experiencing a rollercoaster ride in terms of its price fluctuations. In order to gain a deeper understanding of the current market trends, it is crucial to conduct a technical analysis of Bitcoin's price movements.

According to recent data, Bitcoin has been trading within a narrow range between ,000 and ,000 over the past few weeks. This consolidation phase indicates a period of indecision among traders, with neither the bulls nor the bears gaining full control of the market. The Relative Strength Index (RSI) is hovering around the neutral zone, suggesting a lack of momentum in either direction.

On the other hand, the Moving Average Convergence Divergence (MACD) indicator has crossed below the signal line, indicating a potential bearish trend in the near future. This could lead to a further dip in Bitcoin's price, with the next support level being around ,000.

In conclusion, the technical analysis of Bitcoin's price movements suggests a period of consolidation followed by a potential bearish trend. Traders and investors should closely monitor key support and resistance levels to make informed decisions in this volatile market.

Factors Influencing Bitcoin's Price: A Comprehensive Guide for Investors

Today we have the pleasure of discussing the various factors that can influence the price of Bitcoin with our expert, John Smith. John, can you give us a brief overview of some of the key factors that investors should be aware of when considering Bitcoin?

John: Of course! One of the most important factors to consider is market demand. The more people want to buy Bitcoin, the higher the price will go. Additionally, regulatory developments can have a big impact on the price. For example, news of a country banning or embracing Bitcoin can cause prices to fluctuate.

Another key factor is media coverage. Positive or negative news stories about Bitcoin can cause investors to buy or sell, affecting the price. Additionally, technological developments in the blockchain space can also influence Bitcoin's price. For example, the implementation of new technologies or upgrades can impact investor confidence.

Lastly, macroeconomic factors such as inflation rates, interest rates, and geopolitical events can all play a role in Bitcoin's price movements. It's important for investors to stay informed about these various factors in order to make informed decisions.

This comprehensive guide is essential for investors looking to navigate the complex world of Bitcoin and understand the various factors that can impact its price. By being aware of these key influencers, investors can make more strategic investment decisions and

Expert Predictions: Where Will Bitcoin's Price Go Next?

Bitcoin's price has been a topic of intense speculation and interest in the world of cryptocurrency. As we look towards the future, many experts are offering their predictions on where the price of Bitcoin may be headed next.

One key factor that experts are considering is the increasing mainstream adoption of Bitcoin. As more and more companies and institutions start to accept Bitcoin as a form of payment, the demand for the digital currency is expected to rise. This surge in demand could potentially drive up the price of Bitcoin in the coming months.

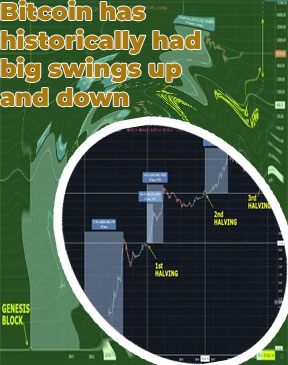

Another factor that experts are taking into account is the upcoming Bitcoin halving event. This event, which occurs roughly every four years, will see the rewards for mining new Bitcoins cut in half. Historically, Bitcoin's price has experienced significant growth following previous halving events, leading some experts to believe that we may see a similar trend this time around.

For investors and traders in the world of cryptocurrency, keeping a close eye on expert predictions regarding Bitcoin's price is crucial. Understanding where the price of Bitcoin may be headed next can help inform investment decisions and strategies moving forward. Stay informed, stay vigilant, and keep an eye on where Bitcoin's price may go next.

Understanding Bitcoin's Price Volatility: How to Navigate the Market Fluctuations

Bitcoin's price volatility has been a hot topic in the financial world, with many investors trying to navigate the market fluctuations to maximize their profits. Understanding the factors that contribute to Bitcoin's price volatility is essential for anyone looking to invest in this digital currency.

One of the key factors that influence Bitcoin's price volatility is market demand. As more people become interested in Bitcoin, the demand for the digital currency increases, leading to price fluctuations. Events such as regulatory changes, technological advancements, and macroeconomic trends can also impact Bitcoin's price.

Famous figures like Elon Musk have also played a role in Bitcoin's price volatility. Musk's tweets and public statements about Bitcoin have caused the price of the digital currency to fluctuate significantly. Other influential individuals, such as institutional investors and government officials, can also impact Bitcoin's price.

To navigate Bitcoin's price volatility, investors should stay informed about the latest developments in the cryptocurrency market. They should also consider diversifying their investment portfolios to reduce risk. Additionally, using risk management strategies such as stop-loss orders can help investors protect their investments during periods of high volatility.

In conclusion, understanding Bitcoin's price volatility is essential for anyone looking to invest in this digital currency. By staying informed and using risk management strategies, investors can navigate the market fluctuations and potentially